The Australian Securities Exchange (ASX) is preparing to welcome Redox Limited, a leading supplier and distributor of chemicals, ingredients, and raw materials, to its prestigious listing on July 3, 2023, at 12:00 PM AEST. As the premier source for IPO news in Australia, IPO Society is delighted to present this upcoming listing, offering investors a valuable opportunity to delve into Redox Limited’s offering. With an ambitious capital raising target of $402 million, this IPO represents an exciting prospect for investors interested in the chemical distribution industry.

Company Overview

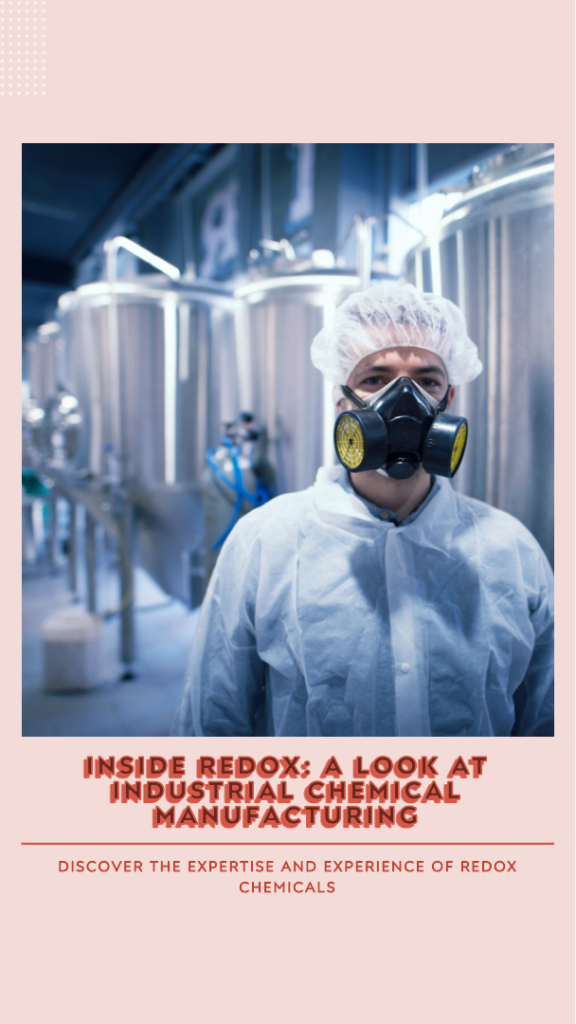

Redox Limited is a prominent player in the chemical distribution landscape, serving clients in Australia, New Zealand, Malaysia, and the United States. The company plays a vital role in the supply chain, connecting manufacturers and end-users across diverse industries. Redox’s comprehensive product portfolio and strong supplier relationships ensure a reliable and efficient distribution network, enabling businesses to access the chemicals, ingredients, and raw materials they require.

Key Details

- Listing Date: July 3, 2023, at 12:00 PM AEST

- Company Contact Details:

- Website: https://redox.com

- Phone: 61 2 9733 3000

Offer Details

Redox Limited’s initial public offering comprises ordinary fully paid shares. Priced at AUD 2.55 per share, the company aims to raise a substantial capital of $402 million. This infusion of funds will fuel Redox’s growth plans, including expanding its product range, strengthening its distribution capabilities, and exploring new market opportunities.

Underwriters

Ord Minnett Limited serves as the underwriter for the Redox Limited IPO, demonstrating their confidence in the company’s prospects. Additionally, UBS Securities Australia Limited and Ord Minnett Limited act as joint lead managers, supporting Redox Limited’s entry into the public market and ensuring a successful listing process.

Investment Prospects

Redox Limited’s strategic position as a key chemical distributor presents an attractive investment opportunity for discerning investors. The company’s extensive network, spanning multiple countries, offers a competitive advantage in accessing a wide range of markets. Furthermore, Redox’s strong supplier relationships, industry expertise, and commitment to sustainability position it well for future growth.

The chemical distribution industry plays an essential role in numerous sectors, including pharmaceuticals, food and beverages, agriculture, and manufacturing. Redox Limited’s involvement in this critical supply chain enables investors to capitalize on the increasing demand for chemicals, ingredients, and raw materials across various industries. As economies continue to expand and new markets emerge, Redox Limited is primed to benefit from these trends.

Compelling Opportunity

The impending listing of Redox Limited on the ASX represents a compelling investment opportunity for those seeking exposure to the chemical distribution sector. As Australia’s foremost IPO website, IPO Society encourages investors to carefully evaluate the company’s prospectus, align their investment objectives, and seek advice from financial advisors to make informed decisions.

Redox Limited’s robust distribution network, diverse product portfolio, and strong supplier relationships position the company for sustained growth. With a significant capital raising target of $402 million, Redox aims to fuel its expansion plans, enhancing its market position and capitalizing on emerging opportunities.

Don’t miss the chance to be part of Redox Limited’s journey as it enters the public market and continues to play a vital role in supplying chemicals, ingredients, and raw materials across multiple industries.